Moving from a full-time job to freelancing might feel like you’re just switching jobs. But, it’s a bit bigger than that. What you’re really doing is transitioning from an employee to the owner of your own business.

Moving from a full-time job to freelancing might feel like you’re just switching jobs. But, it’s a bit bigger than that. What you’re really doing is transitioning from an employee to the owner of your own business.

Overall, freelancers can make more money and are happier with their lifestyle than they were as full-time employees. However, that freedom comes with a few payoffs. As a business owner, you’ll incur business expenses. Overall

That’s where the hidden expenses of freelancing come in. They include expenses that you didn’t know about or didn’t expect to change.

When you learn to think of yourself as a small business owner, then it will be easier to understand when and why you need to invest in your freelance business. If you want to learn more about budgeting for a variable income, check out our budgeting guide here.

Page Contents

Setting up your business

Website

In order to look professional as a freelancer, you should invest in a website. Not only does this show potential clients that you’re a trusted professional, but it can also be where you have your portfolio.

Keeping your portfolio in one place makes it easier to apply for jobs and reach out to potential clients. So, for most freelancers, a professional website is a necessary investment.

In terms of the price of starting a website, you have to make two purchases. You’ll need a domain name and web hosting services.

Domain Name

Your domain name is the address of your website, for example, www.remotelifegenius.com. When you purchase a domain name, you are purchasing the right to use it. Typically you purchase these rights for one year at a time, and then you renew each year.

Most domains can be set up to auto-renew so you never lose the domain.

A domain name will usually cost somewhere between $2 and $20 per year (they can go that low if there are discounts.) Domain name discounts might only apply for the first year. So, after the first year, your annual cost will be around $15 to $20.

You can purchase domain names from registration sites such as Hostgator, GoDaddy, or Bluehost.

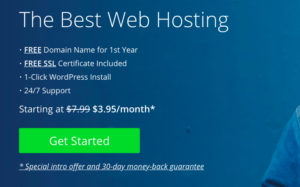

We recommend Bluehost because it comes with a free domain name for 1-year and you can manage your web hosting services all in one place.

Use our discount link to get web-hosting for $3.95/month and a free domain for 1-year.

On Bluehost, you can search to see if the domain you want is available. However, if someone has already purchased that domain, you would have to buy it from them.

Some people sell their domains outright, and it’s usually much more expensive to buy from an individual. Sometimes there are domain auctions where you can purchase domains, but, again, this is more complicated and more expensive.

Web Hosting Services

After you purchase a domain, you also need to purchase web hosting services. This means you’re paying for the technology to host your website online. Your website data is stored on a server, and when someone goes to your website that data needs to be retrieved and sent to their device.

So, it’s necessary to purchase web hosting for your site. As mentioned before, we recommend Bluehost because you can purchase domains and your web hosting plan all at once.

Hosting a website might seem expensive when you’re getting started. But, with our discount link, you can get web hosting for as low as $3.95/month on a 3-year plan. This lets you lock in a low price for three years.

In the end, having a professional website makes you more competitive, which, in turn, helps land better clients and higher-paying gigs.

We recommend Bluehost because it’s the #1 web hosting provider recommended by WordPress. And WordPress powers more than 30% of all websites on the internet. It’s a free service that you’ll use to set up your website and how it looks.

With Bluehost, you can purchase your domain and web hosting then install WordPress all in a matter of minutes.

If you’re more comfortable with web development and transferring web domains, then you may want to browse other options. However, if you’re a beginner without much web development experience, we recommend Bluehost.

Web hosting services can be costly if you don’t know how to select them early on. If you want a step-by-step tutorial on how to create your freelance website, enroll in our 5-Day Website Creator Course. You’ll learn how to select the right tools from the beginning and save yourself time and money in the long run.

Logo design

When you’re creating a website for yourself, a logo can take you from amateur to professional. It’s also a great element to include in email signatures.

Now, this is definitely not a required expense for everyone. If you’re an experienced graphic designer, a logo should be no problem.

For beginners, there are a couple of other options too. You can customize plenty of free logo templates on Canva. On Canva you can easily take your logo and use it to create business cards as well. And, it’s easy to order prints directly from their site.

Or, you can use Wix’s logo creator which asks you a few questions about your brand and generates logo options for you.

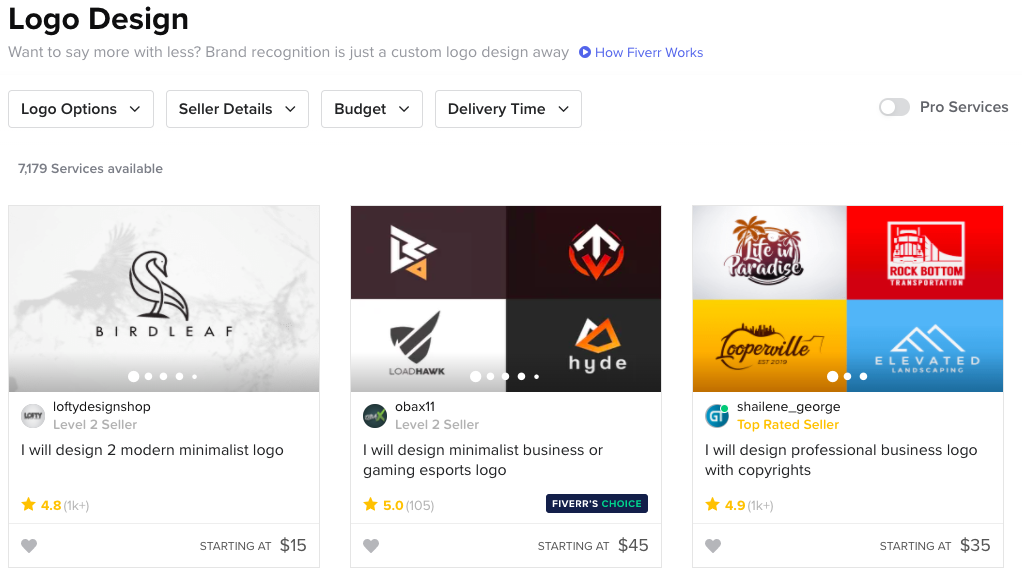

However, you may find as you grow that you want to update your logo or have one made professionally. In that case, Fiverr is a great spot to browse graphic designers. On Fiverr, you can choose from a wide range of graphic designers at different price points. And, it’s always nice to support a fellow freelancer.

However, you may find as you grow that you want to update your logo or have one made professionally. In that case, Fiverr is a great spot to browse graphic designers. On Fiverr, you can choose from a wide range of graphic designers at different price points. And, it’s always nice to support a fellow freelancer.

Software purchases

Certain types of freelancers will also need software. If you’re moving from a full-time role to a freelance role, you may have to purchase the software that your employers previously provided you with.

Software purchases can be basic, like Microsoft Suite, or more involved such as SEO tools or graphic design tools. This varies widely based on the type of freelancing that you do.

However, there are a few software purchases that apply to most freelancers. The first is an accounting or invoicing software. We recommend Quickbooks Self-Employed to help you manage your invoices, income, and expenses. Using software like Quickbooks will also make your life easier each time taxes come around.

Quickbooks self-employed has three options:

- Self-employed

- Self-employed + tax bundle

- Self-employed + tax bundle + live support

You can choose the right program for you based on whether or not you hire your own accountant.

The second software that we recommend for everyone is Grammarly. Grammarly is an AI-powered writing assistant. They have a free extension that will edit the grammar in all your writing and communications.

If you want more advanced assistance, Grammarly Premium can suggest better word choice and grade your writing based on readability and tone.

As a freelancer, it’s important to appear professional. When you look professional you’ll land more clients and be invited back for more repeat business. And there’s nothing that signals unprofessional like spelling errors and grammar mistakes.

Click here to explore and install the free Grammarly Chrome extension.

Self-Employed Taxes

As a freelancer, taxes are much different than an employee. First of all, taxes are not automatically taken out of your payments. Unlike paychecks, your clients are paying you for a specific service or project. This means that your clients are paying you in full.

You, as a freelancer, are responsible for estimating your taxes and paying them each quarter. As a general rule, it’s safe to allocate 30% of each payment to an account for taxes.

This isn’t necessarily a new expense. You’ve always paid taxes for Medicare and Social Security. The difference now is that it’s not automatic.

You will also have to pay what is called the self-employment tax. This is in addition to your income tax. Moreover, it’s the tax you pay as a business owner. It’s similar to the tax that your employer pays for each employee.

We won’t go into too much detail here, but feel free to check out our Freelancer’s Guide to Taxes for a more comprehensive explanation.

Accountants

What may be considered a hidden expense is an accountant. If you were doing your own taxes before, you may have been filing for free or using online software only. That shouldn’t be the case when you’re freelancing.

As a freelancer, you pay estimated taxes each quarter. The estimates are based on your income during that time. Now, estimating quarterly taxes is a complicated process best left to a professional.

Now, some freelancers do prefer to do this themselves. Or, they might choose to go with software like TurboTax or H&R Block. However, we recommend a professional that can help you estimate your taxes properly AND maximize your business deductions.

When you’re self-employed your taxes get more complicated. You’ll have 1099s from each client, a schedule C form to fill out, and all of your business expense receipts. Plus, if you’re still working part or full-time you’ll have your W2 on top of all of that.

By hiring an accountant you’ll be saving time, getting the most out of your taxes, and avoid penalty fees for underpaying your quarterly taxes.

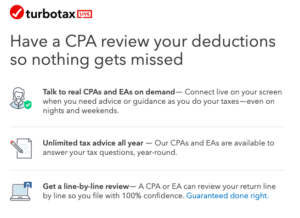

With Intuit TurboTax Self-Employed Live, you can choose the Live option of their service. This gives you access to CPA advice all year-round and you’ll have a tax consultant proof your taxes line by line to make sure you get maximum deductions. And the best part of using TurboTax Live is you only pay when you file.

With Intuit TurboTax Self-Employed Live, you can choose the Live option of their service. This gives you access to CPA advice all year-round and you’ll have a tax consultant proof your taxes line by line to make sure you get maximum deductions. And the best part of using TurboTax Live is you only pay when you file.

If you have a family member or friend who works as an accountant, we recommend starting there. Otherwise, you can also search for accountants online using Google or a directory like the IRS Directory of Tax Preparers.

Healthcare

Most employed individuals get health care from their employers. As a self-employed individual, this responsibility falls to you. Unless you are covered by a family member, spouse, or domestic partner, you will have to find your own plan.

There are several options here including

- COBRA (converting your full-time job health insurance to self-employed)

- Professional Association & groups (for example Freelancers Union)

- Affordable Care Act

- Find local health insurance information at 211.org

You can always shop around the marketplace for plans as well. But, this is an expense to consider if you are not covered by someone else’s plan.

LLC

To incorporate or not to incorporate, that is the question. But let’s start with, what is an LLC. An LLC is a Limited Liability Corporation. It is a legal business structure that you can set up for your business.

Now, this is not a requirement, and you definitely do not need an LLC to get started. Instead, you’ll be considered a sole-proprietor for all legal and tax purposes.

Eventually, filing for an LLC has considerable benefits for freelancers. The main benefit is that you will not be held personally responsible for debts or lawsuits of your business. An LLC also does not change too much about your operations or taxes. You can still be flexible.

The business taxes can still be captured by your personal taxes, as a member of the LLC. However, you’ll have an added layer of protection should anything go wrong. And, you only need one business owner to form an LLC.

The business taxes can still be captured by your personal taxes, as a member of the LLC. However, you’ll have an added layer of protection should anything go wrong. And, you only need one business owner to form an LLC.

When you create an LLC for your business you do have to pay a filing fee to the state. But, creating an LLC is a straightforward process. You have to file the Articles of Organization to your state and pay the filing fee.

LLC Costs and Service Provider Options

There will also be annual or biannual maintenance fees depending on the state that you’re in. Most states require a fee for the Annual/Biannual report, which must be filed each year. Some states will also levy a franchise tax. Again, this tax-rate varies by state. You can check your state’s LLC fees here.

And finally, depending on your state, you may want to work with a service provider to file your LLC documents for you. If your state has a simpler process, you can file yourself without the extra service fee. However, if you want to be on the safe side you can use Zenbusiness ($49 + state fees) or LegalZoom ($79 + state fees) for help with filing for your LLC.

If you have already created a sole-proprietorship, you can convert this to an LLC. The process for doing so depends on each state.

In Conclusion + Expense Summary

Freelancing is an exciting opportunity to take control of your time and your work. Although it’s a one-person operation, it’s still a small business in many aspects.

When you go into freelancing, it’s helpful to expect that there will be expenses associated with running your business. Some are absolutely necessary (self-employment tax and estimated quarterly taxes) while others will help you reach profit faster and save time.

Ultimately, it’s up to you how and when you want to make these investments into your business. However, these are the costs that most freelancers can expect early on.

- Domain hosting for website

- Web hosting services

- Self-employment (SE) Tax

- Professional accountant

- LLC filing fee

- Annual LLC maintenance fees

- Healthcare

As you shift into being a business owner, you’ll also start to value your time more. You’ll realize that you are creating the most value (and income) when you’re interacting with clients and providing services.

Certain expenses might seem like a lot at first. But, over time, you’ll realize the true value of your time. And when you start to understand that value, then these expenses will appear small in comparison to your income.